2024-2025 Federal Budget Summary

With the budget in surplus for a second year running, it is tipped not to last, with deficits predicted for the next four years after that.

So how will the budget affect you:

For Individuals and Families

Energy rebate for households

To assist households with energy bill relief, from 1 July 2024, all households will have a $300 credit automatically applied to their electricity bills to help ease the cost of rising electricity costs.

Personal tax cuts

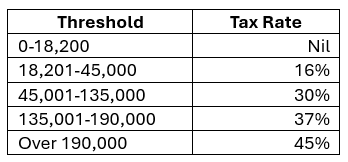

Already previously announced, the treasurer confirmed the Stage 3 tax cuts will remain as already released. This will mean the individual

tax rates from 1 July 2024 will be:

This will save the average taxpayer around $36.00 a week in tax.

Super on government funded parental leave

From 1 July 2025, recipients of Commonwealth funded paid parental leave payments will also benefit from superannuation being paid on top of the benefit. This move helps support the inequity between men and women’s super savings at retirement, due to women’s reduced super savings during parental leave.

Increasing rent assistance

From September 2024 the Commonwealth Rent Assistance payment will increase by 10%. This is an increase of around $19 per fortnight for a single person.

Capping PBS medication

The cost of Pharmaceutical Benefits Scheme listed medications will be frozen for the next two years. Therefore, the price will remain at $31.60 per medicine for Medicare card holders, and $7.70 per medicine for concession card holders and pensioners.

In-home aged care increase

From 1 July 2024, another 24,100 home care packages will be released, allowing more people to seek and get the support they need to stay at home, rather than move into aged care facilities and return home quicker after stays in hospital.

More support for Uni students

Announced in the budget was financial support provided for students undertaking practical placement for teaching, nursing, midwifery and social work courses. Support for these students will be provided in the form of a weekly “Commonwealth Prac Payment” of up to $319.50 while on placement. The payment will be means tested but will be in addition to any other income support payments students are already receiving and will start in mid-2025.

Debt indexation on student loans changes have also been announced and will be backdated to last year, wiping out an estimated total of $3 billion on student loans. The new measures will see the HELP indexation rate to be the lower of either the Consumer Price Index or the Wage Price Index. In real terms this will see the indexation that was applied on 1 June 2023 reduced from 7.1% down to 3.2%. This will include all HELP, vocational education and training (VET) Student Loan, Australian Apprenticeship Support Loan and other student support loans that existed on 1 June 2023.

Foreign resident CGT rules

New rules will require foreign residents disposing of shares or other membership interests, greater than $20m, to report the event to the ATO, prior to the transaction taking place. There will also be broadening and further clarification around the types of assets foreign residents will pay CGT on.

Increase in Medicare levy low income threshold

In a backdated measure to 1 July 2023, the Medicare levy low-income threshold has been increased for singles from $24,276 to $26,000. For couples, it has been increased from $40,939 to $43,846. The additional amount of threshold for each dependent child or student has also been increased from $3,760 to $4,027.

For Small Business

$20,000 small business instant asset write off

Originally due to end on 30 June 2024, the instant asset write off has now been extended to 30 June 2025. This measure is a tax break for small businesses with a turnover over less than $10 million which allows them to claim an instant tax deduction on new equipment purchased, up to the value of $20,000.

Energy rebate

From 1 July 2024, eligible small businesses will receive a $325 reduction off their electricity bills divided into equal quarterly instalments.